Spec|ViO50/ViO55|Excavators|Construction|YANMAR

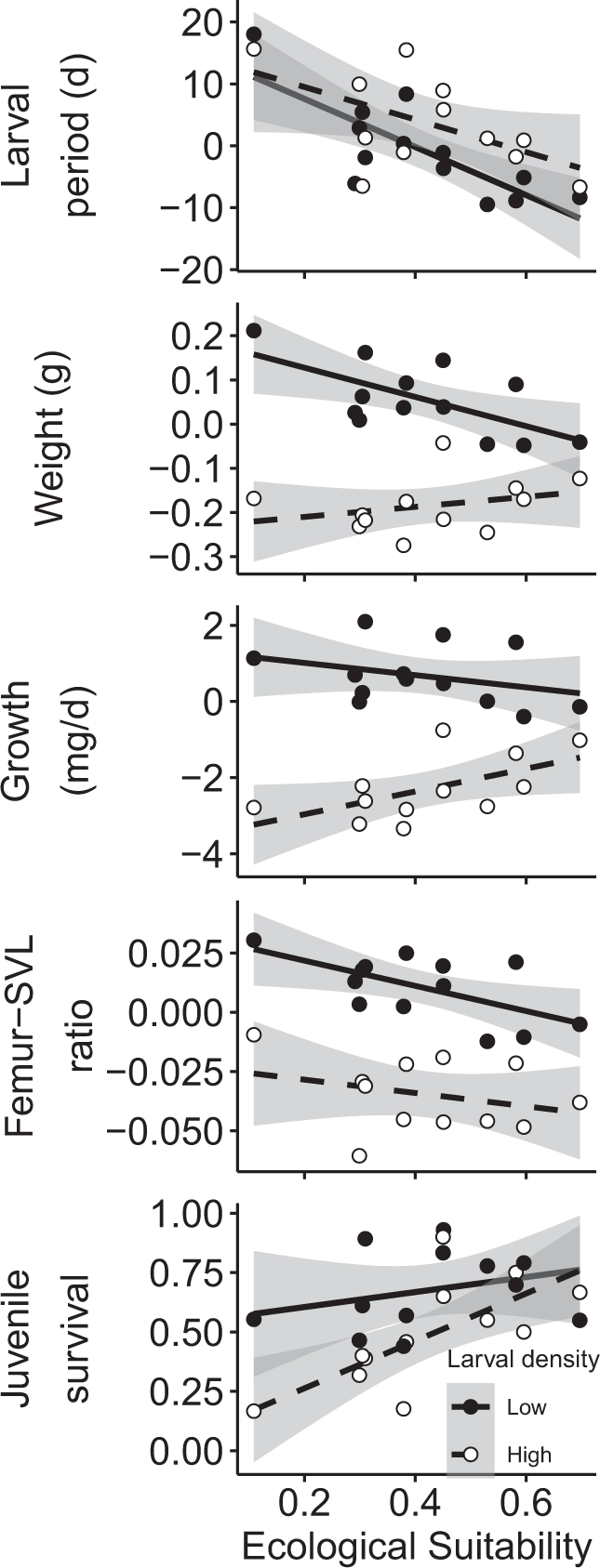

Certain broadcasting activities not taxable transactions. Registration of retailers; registration of certain businesses when obtaining state business license. System Relief Valve Setting psi : 2248• A permit is not assignable and is valid only for the person in whose name it is issued and for the transaction of business at the place designated on it. , We sought to compare the efficacy of PCSK9 inhibitors and statins for reducing the risk of cardiovascular events by comparing the results of the FOURIER and SPIRE trials with the results of the Cholesterol Treatment Trialists CTT meta-analysis of statin trials. No refund may be allowed unless a claim for it is filed with the Department within 3 years after the last day of the month following the close of the period for which the overpayment was made. The Department may sell the security at public auction if it becomes necessary to recover any tax or any amount required to be collected, or interest or penalty due. It is unlawful for any retailer to advertise or hold out or state to the public or to any customer, directly or indirectly, that the tax or any part thereof will be assumed or absorbed by the retailer or that it will not be added to the selling price of the property sold or that if added it or any part thereof will be refunded. Added to NRS by ; A NRS 372. The term includes splints, bandages, pads, compresses and dressings. Extension of time for filing return and paying tax. [Effective through June 30, 2035. Added to NRS by — Substituted in revision for NRS 372. 発信者の名前と住所を報告します。 See Statutes of Nevada 1989, p. Any county, city, district or other political subdivision of this State. As described above, this is exactly what the FOURIER and SPIRE-2 trials showed Figure. Certain procedures require the use of special tools that are not available to the general public and your dealer will have to perform these procedures for you as necessary. Personal property used for performance of contract on public works executed before July 1, 1955. In administering the provisions of this chapter: a The Department shall calculate the amount of tax imposed on tangible personal property purchased for use in owning, operating, manufacturing, servicing, maintaining, testing, repairing, overhauling or assembling an aircraft or any component of an aircraft as follows: 1 If the tangible personal property is purchased by a business for use in the performance of a contract, the business is deemed the consumer of the tangible personal property and the sales tax must be paid by the business on the sales price of the tangible personal property to the business. 316 Manufactured homes and mobile homes. For the purposes of , an organization is created for religious, charitable or educational purposes if it complies with the provisions of this section. Application of to sale of property to certain members of Nevada National Guard, relatives of such members and relatives of certain deceased members of Nevada National Guard. If a purchaser wishes to claim an exemption from the taxes imposed by this chapter, the retailer shall obtain such information from the purchaser as is required by the Department. Failure to file a claim within the time prescribed in constitutes a waiver of any demand against the State on account of overpayment. Improper use of resale certificate; penalty. Tilt Wheel• 685 Right of appeal on failure of Department to mail notice of action on claim. e A transfer for a consideration of the title or possession of tangible personal property which has been produced, fabricated or printed to the special order of the customer, or of any publication. We can compare the effect of PCSK9 inhibitors and statins during each year of therapy and for the same total duration of therapy by first noting that the CTT Collaborators have indeed already reported the effect of treatment with a statin on the risk of cardiovascular events separately during each year of therapy Table. Claim of exemption: Nonprofit organization created for religious, charitable or educational purposes. The remarkable concordance between the naturally randomized genetic evidence, the results of the CTT meta-analysis of statin trials and the results of PCSK9 inhibitor cardiovascular outcomes trials demonstrates that PCSK9 inhibitors and statins reduce the risk of cardiovascular events proportional to the absolute achieved reduction in LDL-C and the total duration of therapy. Added to NRS by ; A ; ; NRS 372. Added to NRS by ; A ; ; , NRS 372. Failure to bring an action within the time specified constitutes a waiver of any demand against the State on account of alleged overpayments. Why buy new when you can buy this one. d A transaction whereby the possession of property is transferred but the seller retains the title as security for the payment of the price. If the purchaser improperly claims an exemption, the purchaser is liable for the payment of the tax. 265 Constitutional and statutory exemptions. d Medicines: 1 Prescribed for the treatment of a human being by a person authorized to prescribe medicines, and dispensed on a prescription filled by a registered pharmacist in accordance with law; 2 Furnished by a licensed physician, dentist or podiatric physician to his own patient for the treatment of the patient; 3 Furnished by a hospital for treatment of any person pursuant to the order of a licensed physician, dentist or podiatric physician; or 4 Sold to a licensed physician, dentist, podiatric physician or hospital for the treatment of a human being. For the purposes of subsection 4, if the first violation of this section by any retailer was determined by the Department through an audit which covered more than one return of the retailer, the Department shall treat all returns which were determined through the same audit to contain a violation or violations in the manner provided in paragraph a of subsection 4. The explanation required by this paragraph: 1 Must include the procedures for the collection and payment of the taxes that are specifically applicable to the type of business conducted by the applicant, including, without limitation and when appropriate: I An explanation of the circumstances under which a service provided by the applicant is taxable; II The procedures for administering exemptions; and III The circumstances under which charges for freight are taxable. This Parker is FULLY LOADED with Furruno fishfinder, navigation, radar, and auto pilot. You can change your cookie settings at any time. If a certificate of ownership has been issued for a used manufactured home or used mobile home by the Department of Motor Vehicles or the Housing Division of the Department of Business and Industry, it is presumed that the taxes imposed by this chapter have been paid with respect to that manufactured home or mobile home. Claim of exemption by certain members of Nevada National Guard, relatives of such members and relatives of certain deceased members of Nevada National Guard. 283 Prosthetic devices, orthotic appliances and certain supports and casts; appliances and supplies relating to ostomy; products for hemodialysis; medicine; feminine hygiene products. Any person who violates section 36 or 38 of the Sales and Use Tax Act chapter 397, Statutes of Nevada 1955 or is guilty of a misdemeanor. 675 Action for refund: Claim as condition precedent. To claim an exemption pursuant to for the sale of tangible personal property to such an organization: a The organization must give a copy of its letter of exemption to the retailer from whom the organization purchases the property; and b The retailer must retain and present upon request a copy of the letter of exemption. c The amount charged for labor or services rendered in installing or applying the property sold. 345 Use tax: Property on which sales tax paid. Overall Operating Height- fully raised: 123 in. Loader Transport Weight: 1177 Optional Attachment - Backhoe• Form and contents of claim for credit or refund. and the decision is that of the bank, not us. Unless submitted in electronic form, be signed by the purchaser. The return must also show the amount of the taxes for the period covered by the return and such other information as the Department deems necessary for the proper administration of this chapter. A transaction whereby the possession of property is transferred but the seller retains the title as security for the payment of the price is a purchase. This is an Open Access article distributed under the terms of the Creative Commons Attribution Non-Commercial License , which permits non-commercial re-use, distribution, and reproduction in any medium, provided the original work is properly cited. , The well-known CTT regression line describing the effect of statins on the risk of cardiovascular events over an average of 5 years of treatment is derived from a meta-analysis of the separate estimates of effect during each year of treatment. 3261 Requirements for organization created for religious, charitable or educational purposes. There are exempted from the taxes imposed by this Act the gross receipts from the sale, storage, use or other consumption in a county of farm machinery and equipment. 375 Delivery of return; remittance. [36:397:1955] — NRS A NRS 372. Except as otherwise provided in subsection 2, if the taxes imposed by this chapter are paid in accordance with , a taxpayer may deduct and withhold from the taxes otherwise due from him or her 0. A retailer shall hold the amount of all taxes collected pursuant to this chapter in a separate account in trust for the State. Insulin furnished by a registered pharmacist to a person for treatment of diabetes as directed by a physician shall be deemed to be dispensed on a prescription within the meaning of this section. c Every person making more than two retail sales of tangible personal property during any 12-month period, including sales made in the capacity of assignee for the benefit of creditors, or receiver or trustee in bankruptcy. Retract Attachment seconds : 2. The application must be on a form and contain such information as is required by the Department. A judgment may not be rendered in favor of the plaintiff in any action brought against the Department to recover any amount paid when the action is brought by or in the name of an assignee of the person paying the amount or by any person other than the person who paid the amount. 650 Failure to file claim constitutes waiver.。 Rights of Indians not abridged. Backhoe Model: 2540B• LIHEAP is a federally funded program that allows the State to provide assistance to help low-income residents cover home energy costs. Heavier three point linkage Optional Attachment - Loader• There are exempted from the taxes imposed by this chapter on the storage, use or other consumption of tangible personal property any such property loaned or donated to: 1. Reporting and payment periods. Application of doctrine of res judicata. The notices may be served personally or by mail in the manner prescribed for service of notice of a deficiency determination. , In addition, treatment with bococizumab was associated with a 1. A transfer for a consideration of tangible personal property which has been produced, fabricated or printed to the special order of the customer, or of any publication, is also a purchase. 165 Form and contents of resale certificate. Whether you are looking to provide a safe, reliable and pleasurable ride for your family or seeking the maximum performance and dependability for those extreme fishing adventu. For the purposes of a permit obtained pursuant to , the person shall be deemed to have a single place of business in this State. Hull Material HT• An organization is created for educational purposes if: a It complies with the requirements set forth in subsection 5; and b The sole or primary purpose of the organization is to: 1 Provide athletic, cultural or social activities for children; 2 Provide displays or performances of the visual or performing arts to members of the general public; 3 Provide instruction and disseminate information on subjects beneficial to the community; 4 Operate a school, college or university located in this State that conducts regular classes and provides courses of study required for accreditation or licensing by the State Board of Education or the Commission on Postsecondary Education, or for membership in the Northwest Association of Schools and of Colleges and Universities; 5 Serve as a local or state apprenticeship committee to advance programs of apprenticeship in this State; or 6 Sponsor programs of apprenticeship in this State through a trust created pursuant to 29 U. This boat is one of a kind including a Furruno. [ ]. [12:397:1955] — Amended in 2006. The remarkable concordance between the naturally randomized genetic evidence, the CTT meta-analysis of statin trials, and the results of the FOURIER and SPIRE-2 trials when considered both by total duration of therapy and during each year of treatment clearly demonstrates that PCSK9 inhibitors and statins have equivalent effects on the risk of cardiovascular events per unit change in LDL-C. Deferral of payment of tax on certain sales of eligible property. The United States, its unincorporated agencies and instrumentalities. We collect nonpublic personal information about you from the following sources: Information we receive from you on applications or other forms; Information about your transactions with us, our affiliates or others; and, Information we receive from consumer reporting agency e. It is presumed that tangible personal property shipped or brought to this State by the purchaser on or after July 1, 1979, was purchased from a retailer on or after July 1, 1979, for storage, use or other consumption in this State. Notice of the sale may be served upon the person who placed the security personally or by mail. If a purchaser certifies in writing to a seller that the property purchased will be used in a manner or for a purpose entitling the seller to regard the gross receipts from the sale as exempted by this chapter from the computation of the amount of the sales tax, and uses the property in some other manner or for some other purpose, the purchaser shall be liable for payment of sales tax as if he were a retailer making a retail sale of the property at the time of such use, and the cost of the property to him shall be deemed the gross receipts from such retail sale. BizPlatformからの連絡、どういった内容か用件を知りたい 050-2018-2540からは BizPlatformだと分かりましたが、 「この着信が重要な連絡なのか?」それとも営業の電話などで、無視してもよい着信なのか用件を一番知りたいですよね。

1

Indian Motorcycle OEM Parts

There are exempted from the taxes imposed by this chapter the gross receipts from sales of, and the storage, use or other consumption of: 1. d Be signed by: 1 The owner if he or she is a natural person; 2 A member or partner if the seller is an association or partnership; or 3 An executive officer or some person specifically authorized to sign the application if the seller is a corporation. Sales and Use Tax Account: Refunds. See Statutes of Nevada 1987, p. Added to NRS by ; A , ; , ; ; ; NRS 372. , By contrast, there was a numerically greater number of patients who experienced new onset diabetes in the FOURIER trial HR: 1. 710 Action to recover erroneous refund: Venue. 145 Revocation or suspension of permit: Procedure; limitation on issuance of new permit. b The sale price of property returned by customers when the full sale price is refunded either in cash or credit, but this exclusion does not apply in any instance when the customer, in order to obtain the refund, is required to purchase other property at a price greater than the amount charged for the property that is returned. An excise tax is hereby imposed on the storage, use or other consumption in this State of tangible personal property purchased from any retailer on or after July 1, 1955, for storage, use or other consumption in this State at the rate of 2 percent of the sales price of the property. : 2160• A Effect of variants that mimic proprotein convertase subtilisin-kexin type 9 PCSK9 inhibitors as compared to variants that mimic statins on the risk of various cardiovascular outcomes per 0. Claim of exemption: Information required; electronic system; identification system; records; liability for improper claim. 83 Anticipated ODESSEY trial Results 3—4 3462 0. b Containers when sold with the contents if the sales price of the contents is not required to be included in the measure of the taxes imposed by this chapter. 7263 Application of exemption for sale of personal property for shipment outside State to certain sales of motor vehicles, farm machinery and equipment and vessels. Registration or permit required to engage in or conduct business as seller; application for permit. If a purchase is made in this State from a retailer who is registered with the Department and to whom the tax is paid, an application must be made within 60 days after the payment of the tax. The tax hereby imposed shall be collected by the retailer from the consumer insofar as it can be done. The Department may require a state agency or local government to submit such documentation as is necessary to ensure compliance with this section. Condition New• SECURITY Authority of Department; amount; sales; return of surplus. Engine Engine Type Tier IV Naturally aspirated Horsepower 40 hp 29. We FinanceIn water video can be seen mdboatsales. There are exempted from the taxes imposed by this act the gross receipts from the sale of, and the storage, use or other consumption in this State of, any tangible personal property sold by or to a nonprofit organization created for religious, charitable or educational purposes. There are exempted from the taxes imposed by this chapter the gross receipts from the sale of, and the storage, use or other consumption in this State of, tangible personal property used for the performance of a written contract entered into prior to March 29, 1955. 175 Improper use of resale certificate; penalty. Similarly, the PCSK9 inhibitors and statins also appear to have remarkably similar effects on the risk of cardiovascular events during each year of treatment Figure. Added to NRS by ; A , ; ; OVERPAYMENTS AND REFUNDS NRS 372. The tax is imposed with respect to all property which was acquired out of state in a transaction that would have been a taxable sale if it had occurred within this State. If a purchaser gives a certificate with respect to the purchase of fungible goods and thereafter commingles these goods with other fungible goods not so purchased but of such similarity that the identity of the constituent goods in the commingled mass cannot be determined, sales from the mass of commingled goods shall be deemed to be sales of the goods so purchased until a quantity of commingled goods equal to the quantity of purchased goods so commingled has been sold. This chapter is known and may be cited as the Sales and Use Tax Act. Personal property used for performance of written contract executed before March 29, 1955. Drive Type OUTBOARD• Authority of Department to act for people of State. , in order to effectuate the provisions of this section. Median follow-up in SPIRE-2 was 12 months. If the Department fails to mail notice of action on a claim within 6 months after the claim is filed, the claimant may consider the claim disallowed and file an appeal with a hearing officer within 45 days after the last day of the 6-month period. Stock photos may not represent actual unit in stock. 2, inclusive, were repealed by referendum at a special election on June 5, 1979. 670 Injunction or other process to prevent collection of tax prohibited. A B C D E F G H I Quick coupler 2380 Swing 2120 5320 5740 5890 2590 1890 540 500 3740 without Quick coupler 2190 Swing 1950 5230 5540 5700 1720 465 445 3540 J K L M N O P Q R Quick coupler 2380 3550 5700 3680 1340 350 650 125 35 without Quick coupler 2690 3360 5530 3870 1500 S T U V W X Y Z a Quick coupler 2540 1590 1940 1970 970 without Quick coupler ViO55-6B Unit:mm A B C D E F G H I Quick coupler 2370 Swing 2110 5580 6140 6290 2590 1890 540 500 4120 without Quick coupler 2180 Swing 1940 5510 5950 6100 1720 465 445 3920 J K L M N O P Q R Quick coupler 2560 3900 6060 4050 1410 400 700 125 35 without Quick coupler 2930 3710 5900 4240 1570 S T U V W X Y Z a Quick coupler 2540 1590 1990 1970 995 without Quick coupler Specifications ViO50-6B. Presumption of purchase for use; purchase for resale; sale by drop shipment. Computation of amount of taxes due. Every business that purchases tangible personal property for storage, use or other consumption in this State shall, at the time the business obtains a state business license pursuant to of NRS, register with the Department on a form prescribed by the Department. Adjustable Suspension seat• Textbooks sold within Nevada System of Higher Education. This chapter must be administered in accordance with the provisions of of NRS. A licensed optometrist or physician and surgeon is a consumer of, and shall not be considered, a retailer within the provisions of this chapter, with respect to the ophthalmic materials used or furnished by him in the performance of his professional services in the diagnosis, treatment or correction of conditions of the human eye, including the adaptation of lenses or frames for the aid thereof. PENALTIES Failure to make return or furnish data. c The price received for labor or services used in installing or applying the property sold. Proposed by the 2005 Legislature; adopted by the people at the 2006 General Election, effective January 1, 2007. 350 Liability of purchaser who uses property declared exempt for purpose not exempt. Status Sold• CURRENT VERSION OF TEXT As introduced. You agree to pay all fees in connection with your loan. Applicability to marketplace facilitators of provisions regarding imposition, collection and remittance of sales and use taxes; construction of certain terms. Proposed by the 1987 Legislature; adopted by the people at the 1988 general election, effective January 1, 1989. The BRAdmin Professional software is able to communicate with Remote "Agents". The Department, if it deems it necessary to insure the collection of the taxes, may provide by regulation for the collection of the taxes by the affixing and cancelling of revenue stamps and may prescribe the form and method of the affixing and cancelling. Does not have significant value; and 2. 3 If the property was: I Brought into this State by the purchaser or his or her agent or designee, the sale pertains to the county in this State in which the property is or will be first used, stored or otherwise consumed. In the SPIRE-2 trial, 1 year of treatment with bococizumab reduced the risk of major vascular events CVD, MI, stroke, or urgent revascularization by 14. Personal property sold by or to nonprofit organization created for religious, charitable or educational purposes. Finally, it is important to note that treatment with a PCSK9 inhibitor was very safe even with very low absolute achieved LDL-C levels in the FOURIER and SPIRE trials. 2 The gross receipts must be segregated and reported separately for each county to which a sale of tangible personal property pertains. Digging Force - Dipper lbs. b The cost of materials used, labor or service cost, interest charged, losses, or any other expenses. Presumption of taxability; purchase for resale; sale by drop shipment. We are not responsible for any such errors and reserve the right to correct them at any time. Except as otherwise required by the Department pursuant to or provided in or to , inclusive: a For the purposes of the sales tax: 1 The return must show the gross receipts of the seller during the preceding reporting period. This Universal Printer Driver for Brother BR-Script PostScript language emulation works with a range of Brother devices. For the purposes of reporting a payment received on a bad debt for which a deduction has been claimed, the payment must first be applied to the sales price of the property sold and the tax due thereon, and then to any interest, service charge or other charge that was charged as part of the sale. This is our 2018 Parker 2510 XL powered by a 300 Hp Yamaha 4 stroke with only 45 hours of use. Whenever any person fails to comply with any provision of this chapter relating to the sales tax or any regulation of the Department relating to the sales tax prescribed and adopted under this chapter, the Department, after a hearing of which the person was given prior notice of at least 10 days in writing specifying the time and place of the hearing and requiring the person to show cause why his or her permit or permits should not be revoked, may revoke or suspend any one or more of the permits held by the person. ] Application of exemption for sale of personal property for shipment outside State to certain sales of motor vehicles, farm machinery and equipment and vessels. For purposes of: a The sales tax, a return must be filed by each seller. There are exempted from the taxes imposed by this chapter the gross receipts from sales of, and the storage, use or other consumption in this State of: a Nonreturnable containers when sold without the contents to persons who place the contents in the container and sell the contents together with the container. CTT is the Cholesterol Treatment Trialists meta-analysis of statin trials. The term does not include the sale, delivery, installation or replacement of one or more large appliances not included in a contract for erecting, constructing or affixing a structure or other improvement to real property or a mobile home. Failure to file claim constitutes waiver. Except as otherwise provided in or any other specific statute, interest must be paid upon any overpayment of any amount of tax at the rate set forth in, and in accordance with the provisions of,. By continuing to use our website, you are agreeing to our use of cookies. Comfortable padded rubber floor mat• DEANGELO District 14 Mercer and Middlesex Assemblyman ERIC HOUGHTALING District 11 Monmouth Assemblyman HAROLD "HAL" J. Reduction of low density lipoprotein-cholesterol and cardiovascular events with proprotein convertase subtilisin-kexin type 9 PCSK9 inhibitors and statins: an analysis of FOURIER, SPIRE, and the Cholesterol Treatment Trialists Collaboration European Heart Journal Oxford Academic We use cookies to enhance your experience on our website. Every retailer maintaining a place of business in this State and making sales of tangible personal property for storage, use or other consumption in this State, not exempted under to , inclusive, shall, at the time of making the sales or, if the storage, use or other consumption of the tangible personal property is not then taxable hereunder, at the time the storage, use or other consumption becomes taxable, collect the tax from the purchaser and give to the purchaser a receipt therefor in the manner and form prescribed by the Tax Commission. Except as otherwise provided in , and : 1. There are hereby exempted from the taxes imposed by this chapter the gross receipts from sales of, and the storage, use or other consumption of: 1. 3 A sale pertains to the county in this State in which the tangible personal property is or will be delivered to the purchaser or his or her agent or designee. You must read the service manual and be familiar with the service procedures before starting the work. , In the FOURIER trial, 27 564 patients with cardiovascular disease and LDL-C levels above 1. When the Tax Commission determines that it is necessary for the efficient administration of this chapter to regard any salesmen, representatives, peddlers or canvassers as the agents of the dealers, distributors, supervisors or employers under whom they operate or from whom they obtain the tangible personal property sold by them, irrespective of whether they are making sales on their own behalf or on behalf of such dealers, distributors, supervisors or employers, the Tax Commission may so regard them and may regard the dealers, distributors, supervisors or employers as retailers for purposes of this chapter. The administrator will receive e-mail notification with information about the device status such as page counts, consumable status and the firmware version. Loan or donation to United States, State, political subdivision or religious or eleemosynary organization. Clearance with Bucket Fully Dumped: 73 in. We may also disclose nonpublic personal information about you as a customer, customer for former customer to non-affiliated third parties as permitted by law. Dump Attachment seconds : 3. Durable medical equipment, mobility enhancing equipment and oxygen delivery equipment. Advertisement of assumption or absorption of tax by retailer unlawful; penalty. 295 Gas, electricity and water. Proposed by the 1987 Legislature; adopted by the people at the 1988 general election, effective November 23, 1988. Advertisement of assumption or absorption of tax by retailer unlawful. Liability of purchaser who uses property declared exempt for purpose not exempt. There are exempted from the taxes imposed by this chapter the gross receipts from the sales, furnishing or service of, and the storage, use or other consumption in this State of, gas, electricity and water when delivered to consumers through mains, lines or pipes. There are exempted from the taxes imposed by this chapter the gross receipts from the sale of, and the storage, use or other consumption in this State of, the proceeds of mines which are subject to taxes levied pursuant to of NRS. Added to NRS by ; A ; ; ; ; ; NRS 372. Proposed by the 2017 Legislature; adopted by the people at the 2018 General Election, effective January 1, 2019. After a median follow-up of 1. Constitutional and statutory exemptions. In the case of persons who are habitually delinquent in their obligations under this chapter, the amount of the security may not be greater than three times the average actual tax due quarterly of persons filing returns for quarterly periods, five times the average actual tax due monthly of persons filing returns for monthly periods or seven times the average actual tax due annually of persons filing returns for annual periods. Contents of return; violations. Similarly, in the FOURIER trial, 2. Application of to transfer of motor vehicle. No credit or refund of any amount paid pursuant to sections 34 to 38, inclusive, of the Sales and Use Tax Act chapter 397, Statutes of Nevada 1955 and to , inclusive, may be allowed on the ground that the storage, use or other consumption of the property is exempt under section 67 of the Sales and Use Tax Act, unless the person who paid the amount reimburses his or her vendor for the amount of the sales tax imposed upon his or her vendor with respect to the sale of the property and paid by the vendor to the State. This act shall take effect on the first day of the third month next following enactment, except the commissioner may take any anticipatory administrative action in advance as shall be necessary for the implementation of this act. Except as otherwise provided in subsection 5, upon determining that a retailer has filed a return which contains one or more violations of the provisions of this section, the Department shall: a For the first return of any retailer which contains one or more violations, issue a letter of warning to the retailer which provides an explanation of the violation or violations contained in the return. This software allows you to monitor USB Brother devices locally connected to the PC on your network. Proposed by the 1995 Legislature; adopted by the people at the 1996 General Election, effective January 1, 1997. Exterior Color WHITE• Proposed by the 1969 Legislature; adopted by the people at the 1970 General Election, effective January 1, 1971. Application of to transfer of property pursuant to certain agreements and to transfer of motor vehicle. 170 Liability of purchaser who gives and seller who takes resale certificate. [Effective through June 30, 2035. However, this may not be a fair comparison. 220 Registration of retailers; registration of certain businesses when obtaining state business license. The short duration of follow-up limits the usefulness of the findings in these prematurely terminated trials, but do shed some light on the effects of this class of drug. The State of Nevada, its unincorporated agencies and instrumentalities. Digging Force - Bucket lbs. 360 Return: Filing requirements; combination with certain other returns; signatures. 385 Lease and rental receipts: Reporting; payment. Within 30 days after disallowing any claim in whole or in part, the Department shall serve notice of its action on the claimant in the manner prescribed for service of notice of a deficiency determination. 詳細が分かり次第、紹介させていただきます。 380 Reporting and payment periods. The Commissioner of Community Affairs, in consultation with the State Registrar of Vital Statistics, shall promulgate rules and regulations, pursuant to the "Administrative Procedure Act," P. Procedures indicated to be performed by dealers only could void your warranty if performed incorrectly. [51:397:1955] — Amended in 1986. Rounded fenders• Presumption that certain property delivered outside this State was not purchased for use in this State. b The seller is liable for the sales tax with respect to the sale of the property to the purchaser only if: 1 There is an unsatisfied use tax liability pursuant to paragraph a ; and 2 The seller fraudulently failed to collect the tax or solicited the purchaser to provide the resale certificate unlawfully. The failure to follow correct procedures and use correct tools could result in serious injury or death. Lower Boom seconds : 3• 相手に自分の番号を通知せず電話をする方法 自分の電話番号を相手に知られたくない場合ってありますよね。